Best Time to Buy a House in New York

Is now a adept time to invest in Manhattan, New York residential property?

Posted by Wei Min Tan on January 25, 2022

The Manhattan, New York residential belongings marketplace had a tremendous yr in 2021. Sales volume was the highest in 32 years, since 1989, considering of low mortgage rates, pent up need, reopening of the economic system and overall optimism as more than 70 percent of New Yorkers take been vaccinated. The streets of NYC feel very normal these days and will be 100% when everyone is back at the office total time.

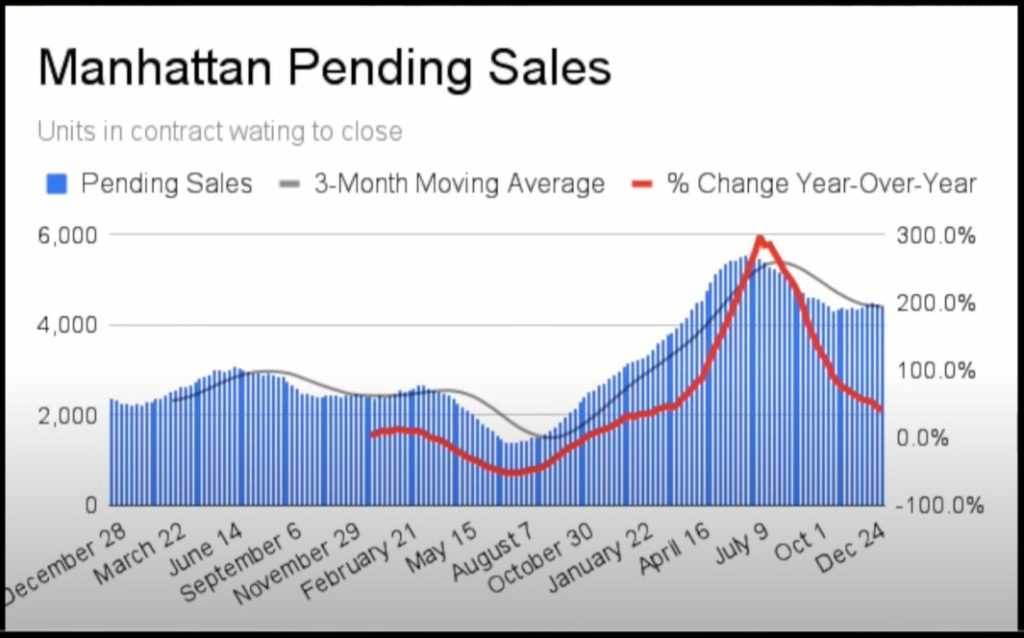

The lesser of the Covid marketplace was between May to July 2020. From in that location, pending sales, referring to contracts in pipeline waiting to shut, was increasing weekly until tardily 2022 when information technology started stabilizing. In Q3 and Q4 2021, nosotros experienced record number of weeks with 300+ contracts signed. Supply was decreasing dramatically as contracts signed exceeded number of new listings coming onto the market. For context, Q4'2021 sales book was 82 percent higher than Q4'2020.

Client'due south three-bedroom condo with open views, we rented out in 1 week. We targeted larger sized apartments post Covid in apprehension of the market's demand for more space.Weimin's article, Investing in large 3-bedroom apartment to rent out in Manhattan.

Covid impact on Manhattan property

The Manhattan market was weak from mid 2022 through 2019. This is despite a strong economy (both U.South. and New York City) and tape low unemployment rates. In Q1'2020, it starting time appeared that nosotros were starting the recovery equally evidenced past an increase in sales book (before March 15, 2020). Then later March 15, 2020, New York City was striking by COVID nineteen at unprecedented levels and the property market came to a standstill.

The real estate market was locked down from mid March 2022 to end of June 2020. As the market place reopened stop of June 2020, uncertainty was at the highest. Clients didn't know how long the recovery would take, retailers closed downwardly, restaurants could not reopen for indoor dining.

The rental marketplace was hit even harder. Because of work-from-dwelling policies at companies, renters didn't renew leases and moved out of Manhattan. New Yorkers had a one time-in-a-lifetime opportunity to work from anywhere they want while saving on Manhattan rents. Market rents dropped 25 percent, inventory shot upwards 3x and vacancy rate shot up 5x.

I am often asked, during pandemic and currently, whether now is a skillful time to invest in Manhattan holding. There is no brusque answer. Permit'due south understand the overall context a bit more.

Why was the Manhattan market soft from 2022 to 2019?

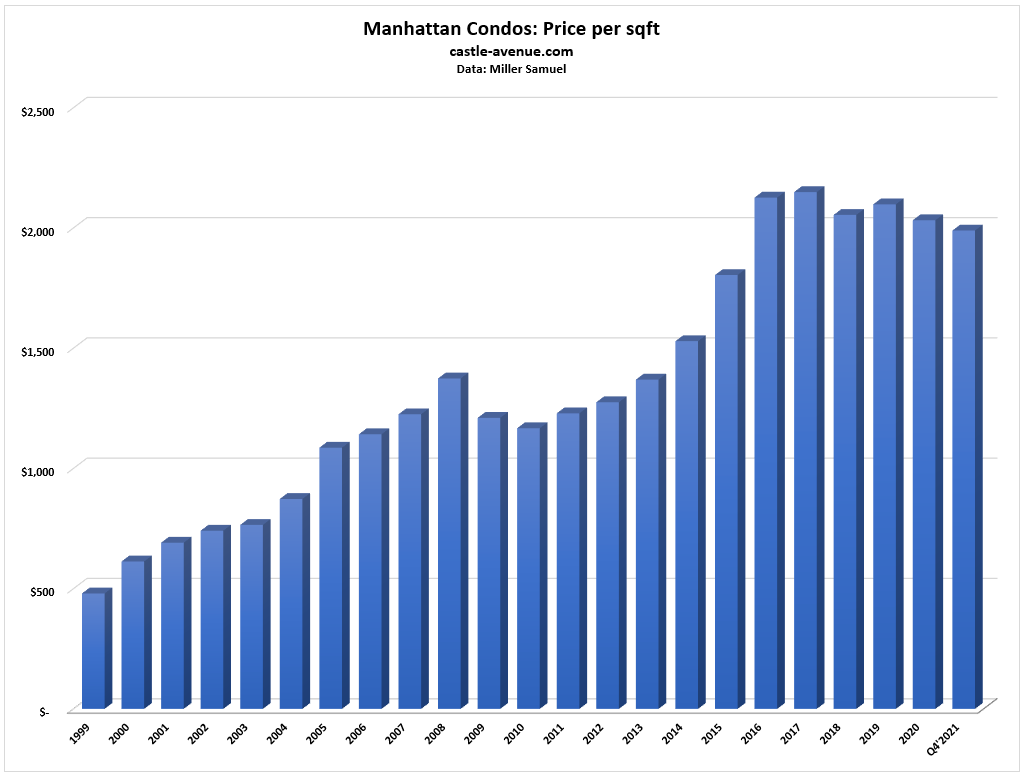

Manhattan property experienced a slowdown from mid 2022 through 2019, typical with belongings cycles. Looking at property price data going back to 1999, Manhattan condominium prices were going upwards from 1999 to 2008, had a dip in 2009 and remained flat in 2010, and then went back up from 2011 to 2017.

Contact: tan@castle-avenue.com

Read almost Wei Min's style in Best Manhattan property agents and Role of a buyer's broker.

The 7-twelvemonth upwards wheel ran its class and 2022 to 2022 was a down cycle. If 2009/2010 can exist a estimate, it previously was downward i year (2009) and remained flat some other twelvemonth (2010). Manhattan experienced a dip between 2022 and 2019, and due to COVID xix, 2022 saw the dip extending every bit the market and entire U.Due south. economy came to a standstill. The original 2022 to 2022 slowdown started with the market'due south reaction to the decreased revenue enhancement deductibility on chief residence property. And and so information technology was driven by (i) increased mansion tax and oversupply in the $5m+ high end segment, (ii) increased inventory, (three) the typical downward bicycle after an up cycle (2011-2017).

Read the latest Manhattan belongings market report

Fear and reopening

Early 2022 saw sales book increasing but then Covid hit NYC. The market came to a standstill from mid March through end of June 2020. Looking back, May to July 2022 was the bottom of the Manhattan marketplace. My clients who bought during that time fabricated the correct motility and got the best deals. But this is hindsight. The doubtfulness and so was how long was the Covid impact going to last, and whether it was the cease of cities and dumbo living.

The media talked nigh the decease of big cities. People started moving out of Manhattan and to the suburbs. The suburbs saw a surge in the real estate market starting effectually July 2020.

Client's West Village investment condo which we negotiated during Covid lockdown in May 2020. Got astonishing terms and price. This twelfth floor flat has a lot of blue sky views, a rare feature in Manhattan.

After the market reopened in July 2020, the existent estate industry slowly resumed among a lot of new protocols. eg Covid forms, very express showings. Urbandigs, a Manhattan data analytics firm, started tracking weekly activity including the charts below.

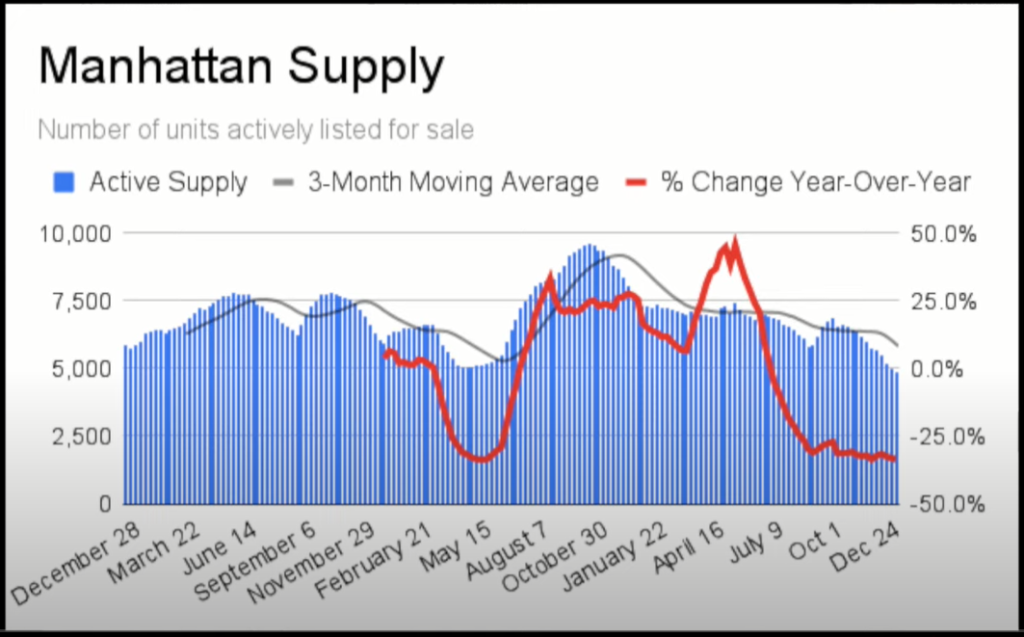

Market place Supply is at a low.

Need: Refers to contracts in pipeline waiting to close. Discover the bottom was around July 2020.

Manhattan holding market comes dorsum

Post Covid shutdown (Mar to June 2020), pending sales, referring to contracts in pipeline waiting to close, increased weekly since July 2022 and only started stabilizing around June 2021. Supply peaked in October 2022 and kept coming down since then. The supply graph above shows we are at a low in terms of supply because number of contracts signed exceeded new listings that came onto the market. The current market is a seller'due south market, driven by:

1) Low mortgage rates

ii) Pent upward need from 2020

3) Optimism from the economic recovery and high adoption of vaccination in New York

Manhattan condominium historical appreciation

Market Pulse shows nosotros are in a seller'southward market and the lesser was in July 2020.

Deal example: Client'southward condo at 111 Murray, opposite Goldman Sachs HQ (the green edifice). Booked at pre-construction, prices up about 20 per centum. Weimin's article, Investing in Tribeca property.

How much Manhattan residential condos cost now

Back in 1999, price per sqft was $480. The elevation was in 2022 at $2,149. The beneath are key data points on a Manhattan condominium in Q4, 2021.

Boilerplate price $2.74m (+ane.6% vs prior year)

Toll per foursquare foot$1,989 (+4.eight%)

Transactions 1,642 (+82%)

Months of supply 5.vii months (-58%)

Sales volume in Q4'2021 increased 82 percentage compared to prior year, and Q4 had the highest sales volume in 32 years! While prices are still lower than pre-pandemic, contracts are being signed every day equally buyers lock in historical low mortgage rates.

Deal example: Client bought and so sold this prewar condo that is one cake from the Globe Trade Eye, New York'due south largest development.

The rental market place is super hot

In 2020, a lot of renters did not renew their leases and moved out of Manhattan. Now, as companies are requiring employees to be back at the function, those who moved out of Manhattan are moving back. This has created a rental market that is red hot, like nothing I've seen earlier. In that location is very petty rental inventory and huge rental demand. In representing landlord owners, we get 10 viewings per day and multiple offers at higher up request toll!

Investor client's prewar condo purchased mail pandemic which nosotros rented in 2 days. Weimin's article, Strategy of investing in distinguished prewar condos.

Why investors globally invest in Manhattan holding

During the pandemic, I represented international clients in negotiating the best terms in memory. Recently, the increase in foreign need increased fifty-fifty farther. Manhattan and London are deemed the world's top two cities for nugget diversification and price stability. These are the globe's only two Alpha++ cities.

Key reasons high net worth individuals globally invest in Manhattan are:

(1) Asset diversification

(2) Stable price increases

(iii) Low credit risk

(iv) Revenue enhancement breaks such as depreciation

Investing in a penthouse Manhattan apartment

When do we render to normal

True normalcy will come when everyone returns to the office. Currently, the tourists are dorsum, restaurants are busy and autonomously from seeing people with masks, one may non even be able to tell we are recovering from a pandemic. But for a local New Yorker, we know we're missing a lot more function people on the streets.

Currently, most companies are having employees at the function several days a week (not full fourth dimension however). Understandably, at that place will be work-from dwelling, but soon office life will exist back to normal. That is when restaurants and businesses volition get their pre-pandemic business book again, and life in NYC goes back to normal.

Weimin'south article , What does a luxury apartment in Manhattan mean?

Is now a good time to invest in Manhattan property?

We are in the beginning of the next up cycle. From history, up cycles usually final virtually 7 years. Sales volume is very high and sellers accept the advantage because there is a lot more than demand than supply. The lesser was more than a yr ago.

Good news is that prices are notwithstanding lower than pre-pandemic. At that place are nevertheless adept buys and negotiability. Information technology's just getting less. In a year or two from at present, prices would be even higher because property prices go up with inflation. Goldman Sachs is optimistic well-nigh 2022 GDP growth considering of reopening of businesses, pent up consumer demand and the fiscal packages boosting consumer and infrastructure spending. According to Goldman, the economic system has shown tremendous resilience during Covid and we are at the nascent stages of the next economical expansion.

Yes, information technology's a good fourth dimension to buy Manhattan property now. We are at the beginning of the next upwards moving ridge.

Read almost How to buy new launch holding in Manhattan

Deal example: Represented multiple buyers at 130 William, FiDi's new development with very low carrying costs and full civilities. Proximity to the Fulton Street subway station and high quality finishes such equally marble bathroom, solid wood doors make this a good buy.

What We Practice

We focus on global investors buying Manhattan condos for portfolio diversification and long term return-on-investment.

1) Identify the right purchase based on objectives

two) Manage the buy process

3) Rent out the belongings

4) Manage tenants

5) Market the belongings at the eventual sale

Notes: This commodity was updated January 25, 2022

Related Articles

Parents buying flat for kid attending Columbia / NYU

How to invest in Manhattan property, turn a profit and repeat

Investing in a pre-war Manhattan apartment

Source: https://www.castle-avenue.com/is-now-a-good-time-to-invest-in-manhattan-new-york-residential-property.html

0 Response to "Best Time to Buy a House in New York"

Post a Comment